Silver Dollars & Trade Dollars of the United States - A Complete Encyclopedia

Q. David Bowers

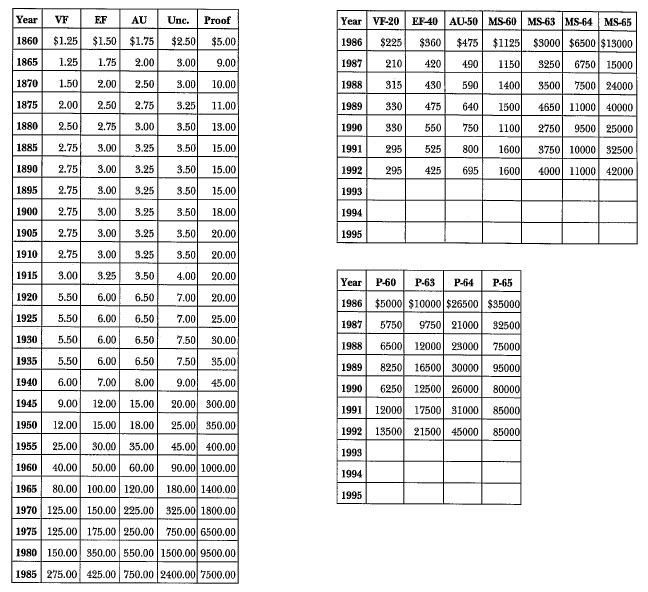

1853 Liberty Seated: Market Values

1853 Liberty Seated: Summary of Characterstics

Business Strikes:

Enabling legislation: Act of January 18, 1837

Designer of obverse: Robert Ball Hughes (after Gobrecht)

Designer of reverse: Robert Ball Hughes (after Reich)

Weight and composition: 412.5 grains; .900 silver, .100 copper

Melt-down (silver value) in year minted: $1.042

Dies prepared: Obverse: 2; Reverse: 1

Business strike mintage: 46,110; Delivery figures by day: April 21: 39,000; December 29: 7,110.

Estimated quantity melted: Unknown

Approximate population MS-65 or better: 2 to 4 (URS-2)

Approximate population MS-64: 10 to 15 (URS-5)

Approximate population MS-63: 15 to 30 (URS-5)

Approximate population MS-60 to 62: 50 to 100 (URS-7)

Approximate population VF-20 to AU-58: 700 to 1,000 (URS-11)

Characteristics of striking: Usually occurs well struck; however, there are exceptions, and some have weak stars, especially stars 9 through 13.

Known hoards of Mint State coins: Possibly a small hoard of Mint State coins existed at one time (see text)

Proofs; (Information does not include the theory of Michael Hodder (as printed in Stack's Starr Collection catalogue) that original Proofs were made. If this theory is confirmed by additional die studies, it will be presented in a future edition of this book.)

Dies prepared: Obverse: 1; Reverse: 1.

Proof mintage: 12 novodels possibly made circa 1862-1863.

Approximate population Proof-64 or better: 2 to 4 (URS-2)

Approximate population Proof-60 to 63: 3 to 6 (URS-3)

Commentary

Among Mint State coins, the 1853 is the only generally available date of the 1850s (until 1859-O).

Additional Information

Effects of the Coinage Act

The Coinage Act of February 21, 1853 brought vast changes to the American monetary system. The weights of silver coins from the half dime to the half dollar were reduced, and the pieces were made subsidiary. To denote the difference, arrowheads were placed alongside the date, a practice continued through 1855.

Silver coins, except the dollar, were now worth more as coins than as metal, and they began to freely circulate. A number of people, including later historians, wrongly thought the United States was going on the gold standard by debasing the silver coins. However, they overlooked the fact that the silver dollar was not changed. (Carothers, Fractional Money, p. 117. Further (per R.W.Julian, letter to the author, March 10, 1992): "The U.S. did go on the gold standard in 1853, although on a de facto basis. It was not until 1873 that de facto became de jure. This fact seems to have escaped most 19th century writers on economics.") The silver crisis was over by 1854, at which time demand (and mintages) for the silver three-cent piece and the gold dollar plummeted; both of these denominations had helped fill the needs of commerce in the early 1850s when silver coins from half dimes upward were hoarded or melted. As it turned out, by November 1856 an ounce of standard silver (.900 fine) sold for $1.24 on the market in terms of gold (an ounce of pure silver was worth $1.38). If the market had risen above $1.25, then $1 face value in silver half dimes, dimes, quarters, or half dollars would have been worth $1 in gold, and a price rise beyond that would have caused hoarding and melting of silver, as occurred in the early 1850s. The situation was perilously close. The same thing would recur decades later in 1919 when silver rose sharply on the market.

In 1853-1854, as newly coined lightweight silver coins began to fill the channels of commerce, foreign silver coins lost much of their utility. Many were turned in to the Mint and recoined into American silver. Most were well-worn Mexican 2-real pieces. In 1857, Director of the Mint James Ross Snowden estimated that $25 million in silver coins was in domestic circulation, of which $20 million was in half dimes, dimes, quarters, and half dollars minted since February 1853, $2 million was in well-worn older (pre-1853) United States coins, and $3 million was in Mexican and other Spanish American fractional issues.

In 1853 the Mint was paying 23-1/2 cents, 10-9/10 cents, 5-1/5 cents for 2-reals, '1-real, and half-real (medio) coins, which was slightly higher than the regular ratings of 23, 10 and five cents allowed in other payments to the government. These higher rates at the Mint seem to have been intended to hasten the withdrawal of foreign coins. (Carothers, Fractional Money, pp. 138-139.)

In the meantime, many copper coins, particularly cents, accumulated in Northern cities. The cost of producing and distributing large copper cents had risen to the point at which Director Snowden said that they "barely paid expenses. At the Mint, experiments were conducted to make cents thinner, narrower, and lighter. Numerous patterns were made.

An announcement made by the United States Mint, Philadelphia, April 5, 1853, stated that "The law regulating the new coinage of silver leaves it optional with the director of the Mint to pay in whatever denomination of coins he prefers. It has been deemed that quarter dollars are the most useful of all silver coins, the whole force of the Mint is now at hand and has been engaged since the first of April upon them only. It is useless, therefore, for parties 'to order returns in various coins." The situation changed later; the Mint made large numbers of dimes and half dimes.

On July 27, 1853 James Ross Snowden, director of the Mint, noted that from and after August 15 payments for silver purchased for the Mint at Philadelphia and the branch mint at New Orleans will be made three-fourths in silver coin of the new standard and one-fourth in gold. Information about the July 27, 1853 statement is from a report in The Bankers' Magazine, September 1853, p. 263.